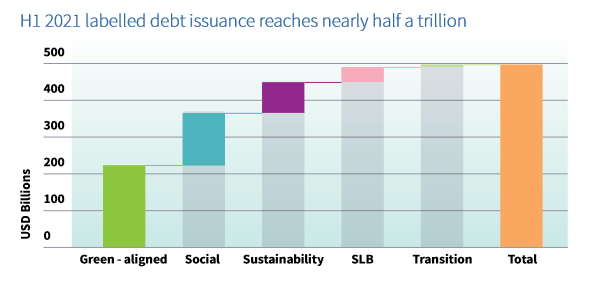

Emissioni sostenibili, quota 500 miliardi in sei mesi

Nei primi sei mesi del 2021 il totale delle emisisoni di debito sostenibile ha raggiunto i 496,1 miliardi, con una crescita del 59% sullo stesso periodo del 2020. Le emissioni riguardano i green, social e sustainability bond (Gss) e i sustainability-linked bond (Slb). I dati sono stati diffusi dalla Climate Bonds Initiative nel suo ultimo report e anticipano una chiusura d’anno in rialzo rispetto al record del 2020 di 639,3 miliardi.

I maggiori volumi hanno riguardato i green bond, con 227,8 miliard, i social & sustainability bond si sono attestati complessivamente a 233,3 miliardi con una crescita del 18% sullo stesos periodo del 2020 mentre i sustainability-linked bond si sono attestati a 32,9 miliardi rappresentando il 6% del totale del debito sostenibile. Nel primo semestre 2020 non si erano invece registrate emissioni di questo tipo.

Sustainability-linked bonds

Sustainability-linked Bonds (SLB) are forward-looking, performance-based debt instruments issued with specific Key Performance Indicators (KPIs) and Sustainability Performance Targets (SPTs) at the level of an entire entity.

The first half of 2021 saw the SLB market segment soar: SLB issuance in H1 2021 amounted to USD32.9bn, representing 6% of the total labelled debt issuance of USD496.1bn. In contrast, no SLB issuance was recorded in the equivalent period of H1 2020.

Transition bonds

Transition bonds are designed to allow high emitters to fund their shift towards cleaner and more sustainable operations. When thoughtfully constructed, these debt instruments can be pivotal in supporting a global, economy-wide transition to the Paris Agreement targets.

The labelled transition bond segment remains nascent. Climate Bonds identified five transition bonds (USD2.2bn) issued in the first half of the year, and a cumulative total of 18 (USD6.4bn) since market inception.

Climate Bonds InitiativeGreen BondGss bondsustainablity-linked bond